|

|

Trouble with Quantitative Easing

Indications are that the Federal Reserve will resume its purchases of US

Treasury bonds. "There would appear -all else being equal -to be a case for

further action," Chairman Ben Bernanke is quoted as saying at a conference. He

argues that the resumption of quantitative easing could reduce long-term

interest rates and encourage growth.

Relatively high unemployment and slower-than-expected growth this year, forecast

to continue into 2011, are the main arguments for QE2. Another reason the

central bank is contemplating this step is that inflation is low, with core

inflation -that is, excluding food and energy -at 1.4% as of August.

Other Fed officials sounded largely in agreement the Chairman Bernanke but

Federal Reserve Bank of Kansas City President Thomas Hoenig strongly dissented.

"Dumping another trillion dollars into the system now will most likely mean they

will follow the same path into excess reserves, or government securities, or

'safe' asset purchases, with a 'minor' impact on stock prices," he said.

Mr. Hoenig argues that there is no strong evidence additional liquidity would be

effective in spurring new investment or consumption. Some are worried about

fueling inflation with further QE. But on the other side of the policy spectrum

is the fear that the United States is following Japan into deflationary

stagnation.

All this makes for an interesting time in fixed income markets-which have

attracted large capital inflows. Below, Jay Feuerstein of 2100Xenon gives a

fixed income futures trader's perspective on monetary policy.

While Mr. Feuerstein is not optimistic regarding the impact of QE2 on the

economy at large, he sees other, more recent, Fed actions as having a beneficial

effect. As for fixed income futures trading, quantitative easing will likely

create more opportunities in bonds and yield curves.

For a profile of Mr. Feuerstein, see the previous section, Founders.

In March 2009, having taken down short-term interest rates as low as they can

go, the Federal Reserve decided to try a novel policy. It bought bonds in

massive quantities so as to boost banks'ability to lend. In that first round of

quantitative easing, the Fed purchased more than $1 trillion of Treasury and

agency fixed-income securities.

Recently Federal Reserve Chairman Ben Bernanke argued in favor of further asset

purchases by the central bank to combat continuing economic weakness. This

so-called QE2 could mean another $1 trillion or more of purchases.

Improving bank balance sheets is the purpose of quantitative easing. The idea is

to shore up banks' capital so that they will lend more. So far, QE1 has not

worked because banks are not lending much. This is nothing new; the same thing

happened during the 1930s Great Depression. The Fed bought bonds and posted them

to bank balance sheets, yet the banks did not lend.

At the time John M. Keynes called this kind of situation a liquidity trap. As he

saw it, expectations could become so dismal that no matter how much money is put

into the system, people stuff it into mattresses. But Nobel laureate Milton

Friedman and other monetarist economists disputed this.

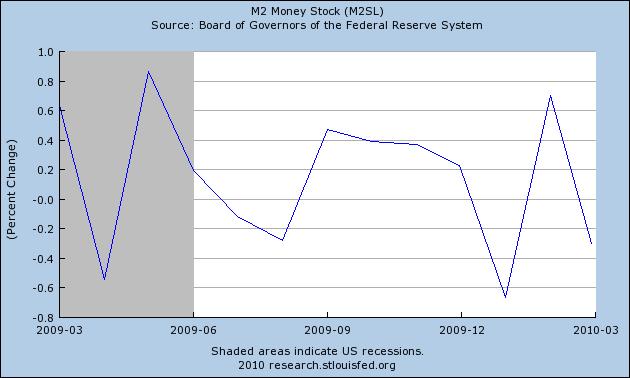

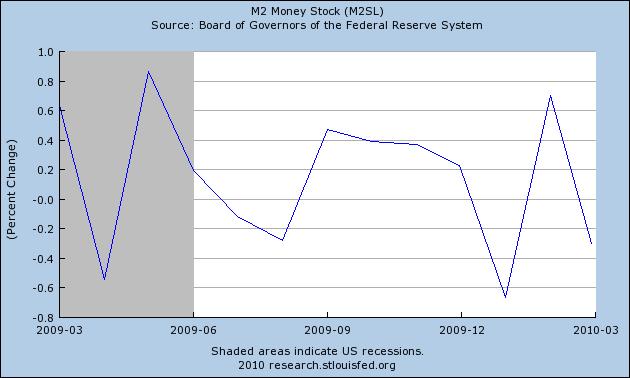

Graph One

Source: Constructed with data and analytics from the Federal Reserve Bank of St.

Louis

Using Friedman's perspective, we see that QE does not insure that money will get

into the system. This is where the Fed is wrong. Banks are not inclined to lend

much, no matter how their balance sheets are bolstered. Monetary policy did not

result in money supply growth. On the contrary, money supply, as measured by M2,

grew at an anemic rate. (Graph One shows basically flat M2 growth in the 12

months after the first round of quantitative easing.)

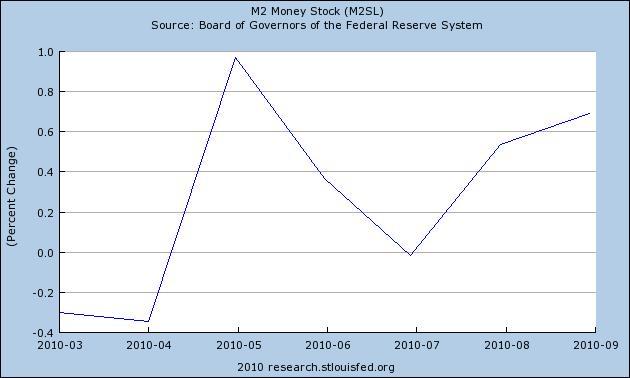

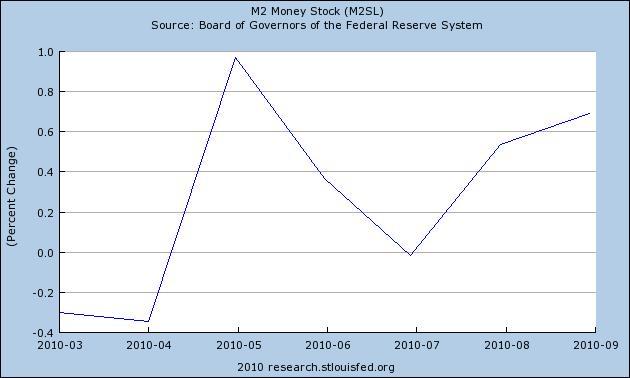

Friedman would advise putting money directly into the system to encourage

spending. The Fed is only now doing that with permanent open market operations,

which really will add money to the system. (Graph Two for the past six months

suggests some increase in M2 growth).

Hyperinflation?

This difference in monetary policy is rooted in another key divergence. Mr.

Bernanke believes that you need to tend to banks to have a healthy economy. But

the late Mr. Friedman saw the health of the banking system as no more important

than the health of any other sector. To summarize his main argument: stable

money growth is the key to a strong economy.

What about concerns that injecting more money will set off hyperinflation? Yes,

excessive money growth will create systematic inflationary pressures that may

linger for decades. But that is not the urgent issue right now. There will be

time to adjust policy once the economy gets back on track.

Despite policy mistakes and continuing risks, the US is not like Japan and does

not have the structural problems that paralyzed the Japanese financial system

for years. I'm optimistic that the Fed will get monetary policy right eventually

and avoid Japan-style deflationary stagnation.

Meanwhile, bond markets and yield curves offer great investment opportunities-if

you have the requisite experience and skills.

Graph Two

Source: Constructed with data and analytics from the Federal Reserve Bank of St.

Louis

|

RSS

RSS